Every day, businesses make costly assumptions about what their customers want. These guesses lead to wasted resources, missed opportunities, and frustrated customers. According to research, companies that make decisions based on customer data are 23% more profitable than those that rely on intuition alone. The solution? Well-designed customer surveys that elicit honest, actionable feedback. In this comprehensive guide, we’ll walk you through the entire process of customer survey creation, from setting clear objectives to analyzing results and implementing changes that drive real business growth.

The True Cost of Guessing vs. Data-Driven Decisions

When businesses operate on assumptions rather than customer data, the consequences can be severe. Product launches fail, marketing campaigns miss the mark, and customer service initiatives fall flat. Consider these sobering statistics:

- 95% of product innovations fail within their first year

- Only 22% of businesses are satisfied with their conversion rates

- 68% of customers leave because they believe a company doesn’t care about them

These failures often stem from a fundamental disconnect between what businesses think customers want and what customers actually need. Customer surveys bridge this gap, providing direct insights that eliminate guesswork and align business strategies with genuine customer preferences.

Effective customer survey creation isn’t just about asking questions—it’s about asking the right questions in the right way to uncover actionable insights that drive meaningful improvements.

Pre-Survey Preparation: Setting the Foundation for Success

Before creating your first question, proper preparation ensures your survey will yield valuable insights. This critical groundwork involves three key elements:

Defining Clear Survey Objectives

Every effective survey begins with a specific purpose. Are you measuring customer satisfaction with a recent purchase? Gathering feedback on a new feature? Understanding why customers are churning? Your objective will shape every aspect of your survey design.

“A survey without a clear objective is like a ship without a destination—you’ll collect data, but you won’t know what to do with it.”

For example, if your objective is to improve your onboarding process, your survey should focus specifically on the customer’s experience during those first crucial interactions with your product or service.

Identifying Target Audience Segments

Different customer segments have different needs and perspectives. Segmenting your audience ensures you’re asking relevant questions to the right people. Consider segmenting by:

- Purchase history (new vs. returning customers)

- Usage patterns (power users vs. occasional users)

- Demographics (age, location, industry)

- Customer lifecycle stage (prospects, new customers, loyal customers)

Tailoring your questions to specific segments yields more precise insights. For instance, asking new customers about their onboarding experience will provide different value than asking the same questions to long-term users.

Remember that segmentation also helps you analyze results more effectively, allowing you to identify patterns within specific customer groups.

Determining Optimal Survey Timing

Timing significantly impacts response rates and data quality. Send your survey too early, and customers won’t have enough experience to provide meaningful feedback. Too late, and their memories of the experience may have faded.

| Interaction Type | Optimal Timing | Rationale |

| Product purchase | 3-7 days after delivery | Allows time for initial use while experience is still fresh |

| Customer support interaction | Within 24 hours | Immediate feedback while details are clear |

| Software onboarding | After key milestones are completed | Captures feedback at critical learning moments |

| Service subscription | Midway through billing cycle | Provides time for evaluation before renewal decision |

Strategic timing also means avoiding survey fatigue. Space out your surveys appropriately—bombarding customers with too many requests will lower response rates and damage your relationship.

Ready to Start Creating Effective Surveys?

Download our free customer survey template pack with proven question formats, distribution strategies, and analysis frameworks. Start gathering actionable insights today!

Crafting Questions That Get Honest, Actionable Responses

The heart of effective customer survey creation lies in thoughtful question design. Well-crafted questions elicit honest, detailed responses that provide genuine insight into customer thinking.

Essential Question Types and When to Use Them

Different question formats serve different purposes. Here’s how to choose the right type for your objectives:

Multiple Choice Questions

Best for: Categorizing responses and quantitative analysis

Example: “How did you hear about our product?”

- Social media

- Search engine

- Friend/colleague

- Advertisement

- Other (please specify)

Tip: Always include an “Other” option with space to elaborate.

Rating Scales

Best for: Measuring satisfaction, agreement, or importance

Example: “How satisfied are you with our customer support?”

Tip: Use consistent scales throughout your survey (1-5, 1-10) to avoid confusion.

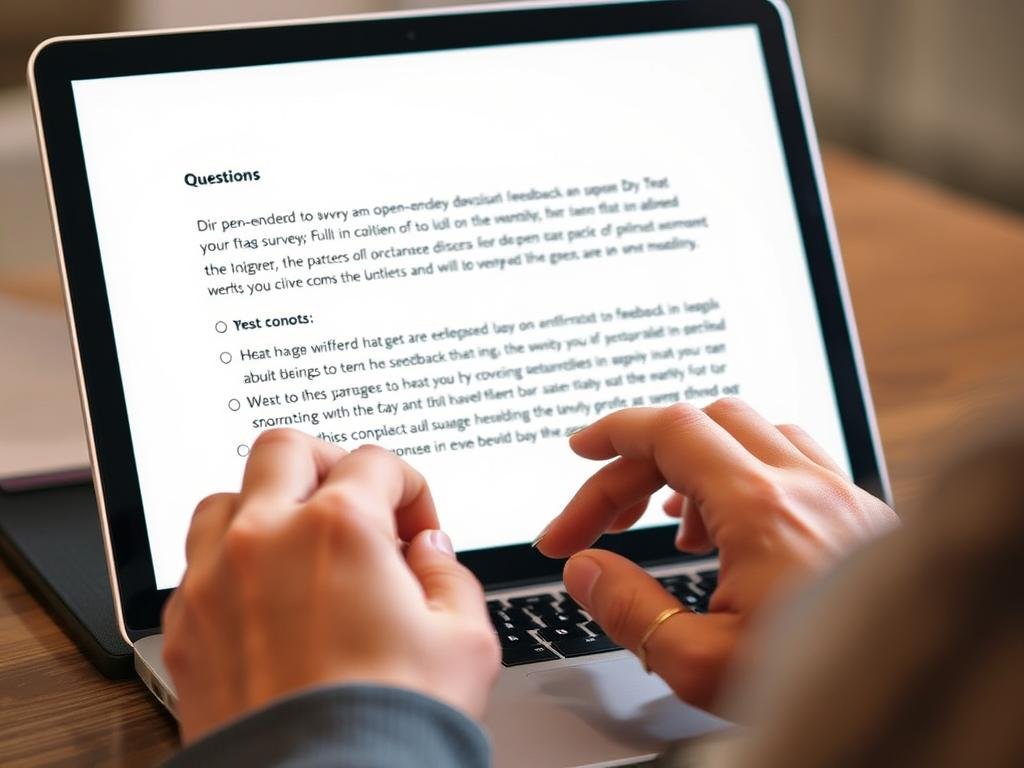

Open-Ended Questions

Best for: Gathering detailed feedback and unexpected insights

Example: “What improvements would make our product more valuable to you?”

Tip: Limit open-ended questions to 2-3 per survey to prevent respondent fatigue.

Likert Scale Questions

Best for: Measuring attitudes and opinions with nuance

Example: “The onboarding process was easy to follow.”

- Strongly disagree

- Disagree

- Neither agree nor disagree

- Agree

- Strongly agree

Tip: Use an odd number of options to allow for neutral responses.

Net Promoter Score (NPS)

Best for: Measuring customer loyalty and satisfaction

Example: “How likely are you to recommend our product to a friend or colleague? (0-10)”

Tip: Follow up with “What’s the primary reason for your score?” to gain context.

Binary Questions

Best for: Simple yes/no decisions or filtering respondents

Example: “Have you contacted our support team in the past 30 days?”

- Yes

- No

Tip: Use binary questions to create logical paths through your survey, showing relevant follow-up questions based on responses.

Best Practices for Question Wording

How you phrase your questions dramatically affects the quality of responses. Follow these guidelines to avoid common pitfalls:

Do This

- Use clear, simple language

- Ask about one thing per question

- Be specific about timeframes

- Use neutral wording

- Provide balanced response options

Avoid This

- Using jargon or technical terms

- Asking double-barreled questions

- Being vague about time periods

- Using leading or biased language

- Offering skewed response options

“The way you ask a question determines the answer you’ll get. Neutral wording is essential for gathering honest feedback rather than confirmation of what you want to hear.”

Real-World Example: Question Transformation

| Poor Question | Improved Question | Why It’s Better |

| “Don’t you agree our new feature is amazing?” | “How would you rate the usefulness of our new feature?” | Removes leading bias and allows for honest assessment |

| “How satisfied were you with our product and customer service?” | “How satisfied were you with our product?” (Separate question for service) | Addresses one topic per question for clearer feedback |

| “Was our website easy to navigate?” | “Rate how easy or difficult it was to find what you needed on our website.” | Provides a balanced scale instead of a yes/no answer |

Optimal Survey Length

Survey fatigue is real. Research shows completion rates drop significantly after 7-8 minutes of survey time. For most purposes, aim for:

- 5-10 questions for transactional surveys (post-purchase, support interaction)

- 10-15 questions for relationship surveys (overall satisfaction, NPS)

- No more than 25 questions for in-depth research surveys

Remember that one thoughtful, well-answered question provides more value than ten hastily answered ones. Quality always trumps quantity in customer survey creation.

Implementation Strategies: Getting Your Survey in Front of Customers

Even the most perfectly crafted survey is worthless if customers don’t see and complete it. Effective distribution is crucial for gathering sufficient data to make informed decisions.

Choosing the Right Distribution Channels

Different channels reach different segments of your audience. Consider these options based on your survey goals and target respondents:

Email Surveys

Best for: Detailed feedback, relationship surveys

Pros: Reaches existing customers directly, allows for personalization, good for longer surveys

Cons: Lower response rates (typically 10-30%), may miss non-email users

Tip: Use a clear, benefit-focused subject line like “Help Us Serve You Better (5 Min Survey)”

Website/In-App Surveys

Best for: User experience feedback, feature evaluation

Pros: Captures feedback in context, higher response rates, reaches active users

Cons: Limited to current users, may interrupt user experience

Tip: Trigger surveys after specific actions (completing a purchase, using a feature) for contextual feedback

SMS Surveys

Best for: Quick feedback, high priority questions

Pros: High open rates (98%), immediate, mobile-friendly

Cons: Limited to very short surveys, requires phone numbers

Tip: Keep to 1-3 questions maximum and clearly identify your company

Social Media Surveys

Best for: Broad market research, reaching new audiences

Pros: Wide reach, can target specific demographics

Cons: Self-selected respondents, potential for biased sample

Tip: Use platform-native tools (Twitter polls, Instagram question stickers) for higher engagement

QR Code Surveys

Best for: In-person feedback, event evaluation

Pros: Bridges physical and digital experiences, convenient

Cons: Requires smartphone and user initiative

Tip: Place QR codes at physical touchpoints with clear instructions and benefits

Phone Surveys

Best for: In-depth feedback, complex topics

Pros: Personal touch, allows for follow-up questions

Cons: Time-consuming, expensive, lower reach

Tip: Schedule calls in advance and prepare interviewers with clear scripts

Effective Incentivization Strategies

Offering incentives can significantly boost response rates, but the wrong approach can compromise data quality. Consider these balanced approaches:

Effective Incentives:

- Small gift cards ($5-10) for completed responses

- Discount codes for future purchases

- Entry into a prize drawing

- Early access to new features

- Donation to charity for each completed survey

Incentive Best Practices:

- Match the incentive value to survey length and complexity

- Offer incentives to all respondents, not just those with positive feedback

- Clearly state the incentive at the beginning of the survey

- Deliver incentives promptly after survey completion

- Consider non-monetary incentives like sharing results summary

“The best incentive is showing customers that their feedback leads to real changes. When people see you acting on their input, they’re more likely to provide feedback in the future.”

Mobile-Friendly Design Considerations

With over 50% of surveys now completed on mobile devices, optimizing for small screens is essential:

- Use single-column layouts that adapt to screen size

- Create large, touch-friendly buttons (minimum 44×44 pixels)

- Minimize text entry questions on mobile

- Use vertical rather than horizontal scales

- Test your survey on multiple devices before launch

- Keep file sizes small for faster loading

- Enable auto-advance after selection when appropriate

Remember that a frustrating mobile experience will lead to abandoned surveys and lost insights. Always test your survey on multiple device types before distribution.

Turning Responses into Actionable Insights

Collecting survey data is only the beginning. The real value comes from analyzing responses to extract meaningful insights that drive business decisions.

Basic Quantitative Analysis Methods

Start with these fundamental approaches to make sense of your numerical data:

Descriptive Statistics

Calculate averages, medians, and response distributions to understand central tendencies and variations in your data.

Example: “Our average satisfaction score is 7.8/10, with 68% of responses falling between 7-9.”

Trend Analysis

Compare results over time to identify improvements or declines in key metrics.

Example: “Our NPS has increased from 32 to 45 over the past three quarters, coinciding with our new onboarding process.”

Segmentation Analysis

Break down results by customer segments to identify group-specific patterns.

Example: “Enterprise customers rate our support 20% higher than small business users.”

Qualitative Response Categorization

Open-ended responses provide rich insights but require systematic analysis:

- Read all responses to get a general sense of themes

- Create categories based on common topics mentioned

- Code each response by assigning it to one or more categories

- Count frequency of each category to identify major themes

- Extract representative quotes that illustrate key points

Modern survey tools often include text analysis features that can automatically categorize responses and identify sentiment, saving considerable time.

Identifying Patterns and Actionable Insights

Move beyond raw data to extract meaningful insights:

| Data Point | Observation | Insight | Potential Action |

| 65% of new users rate onboarding difficulty as 4/5 or 5/5 | New users find our onboarding process difficult | Complex onboarding may be contributing to our 30% first-month churn rate | Simplify first-time user experience; create better tutorial videos |

| Multiple comments mentioning “can’t find export feature” | Users struggle to locate the export functionality | UI navigation issues are causing frustration with a key feature | Redesign navigation; add prominent export button to dashboard |

| Support satisfaction scores 30% higher when issues resolved in first contact | First-contact resolution strongly impacts satisfaction | Escalations and handoffs are damaging the support experience | Expand agent training; improve knowledge base for faster resolution |

When analyzing results, look for:

- Correlations between different metrics

- Unexpected patterns or outliers

- Differences between customer segments

- Gaps between expectations and experience

- Recurring themes in open-ended responses

Remember that the goal isn’t just to collect data but to extract actionable insights that drive meaningful improvements in your customer experience.

Implementing Findings and Closing the Feedback Loop

The true value of customer surveys comes not from collecting data but from taking action on what you learn. Implementing findings and communicating changes to customers completes the feedback loop and builds trust.

Prioritizing Actions Based on Impact

Not all feedback requires immediate action. Use this framework to prioritize your response:

High Priority:

- Issues affecting many customers

- Problems impacting core product functionality

- Feedback from high-value customers

- Quick wins with minimal implementation effort

Medium Priority:

- Enhancement requests with moderate impact

- Issues affecting specific customer segments

- Improvements requiring moderate resources

- Competitive differentiators

Communicating Changes to Customers

Showing customers that their feedback led to concrete changes builds trust and encourages future participation. Consider these communication channels:

Direct Follow-up

Personally contact respondents who provided significant feedback to share how their input influenced decisions.

Example: “Based on your feedback about our reporting feature, we’ve added the export functionality you suggested. I’d love to show you how it works.”

“You Said, We Did” Updates

Send regular communications highlighting customer feedback and resulting changes.

Example: “In our January survey, 45% of you asked for better mobile support. Today we’re launching our completely redesigned mobile app.”

Product Release Notes

Explicitly connect new features and improvements to customer feedback in release announcements.

Example: “Based on your survey feedback, we’ve simplified the checkout process, reducing steps from 5 to 3.”

Establishing Ongoing Feedback Loops

Customer feedback should be an ongoing conversation, not a one-time event. Create sustainable feedback systems:

- Implement a regular survey calendar with different touchpoints throughout the customer journey

- Create a centralized repository for all customer feedback, regardless of source

- Establish cross-functional review processes to ensure insights reach relevant teams

- Set up tracking mechanisms to measure the impact of changes made based on feedback

- Regularly review and refine your survey strategy based on response rates and insight quality

“The companies that thrive don’t just collect feedback—they build their entire culture around listening to customers and acting on what they learn.”

By systematically collecting, analyzing, and acting on customer feedback, you transform surveys from occasional information-gathering exercises into a powerful engine for continuous improvement and customer-centric decision making.

Start Creating Effective Customer Surveys Today

Download our comprehensive survey toolkit with templates, question libraries, and analysis frameworks. Turn customer feedback into your competitive advantage!

Conclusion: From Guesswork to Data-Driven Decisions

Effective customer survey creation is both an art and a science. By following the principles outlined in this guide—setting clear objectives, crafting thoughtful questions, implementing strategic distribution, and analyzing results systematically—you can transform vague assumptions into concrete insights that drive meaningful business improvements.

Remember that the goal isn’t just to collect data but to build stronger relationships with your customers by demonstrating that you value their input and are committed to meeting their needs. When customers see that their feedback leads to real changes, they become more invested in your success and more likely to remain loyal over time.

Start small if necessary, but start today. Even a simple, well-executed survey can yield insights that transform your understanding of customer needs and set you on the path to more informed, customer-centric decision making.

How often should I survey my customers?

The optimal frequency depends on your business type and customer touchpoints. As a general rule, avoid surveying the same customer more than once per quarter unless they’ve had a significant new interaction with your business. For transactional surveys (after purchase or support interaction), limit to one per transaction with at least 30 days between surveys for the same customer.

What’s a good response rate for customer surveys?

Average response rates vary by industry and survey method, but typically range from 5-30%. Email surveys average 10-15%, while in-app surveys can reach 30-40%. Rather than focusing solely on response rate, pay attention to the quality and representativeness of responses. A 10% response rate from a diverse cross-section of your customer base provides more valuable insights than a 30% rate from only your most engaged users.

Should I use the same survey questions every time for consistency?

For tracking metrics like NPS or CSAT, use consistent questions to measure changes over time. However, supplement these with rotating questions that address current business priorities or emerging issues. This approach gives you both trend data and fresh insights with each survey cycle.